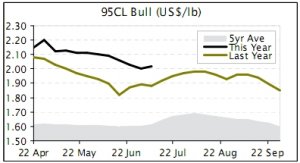

US end users have been buying hand to mouth due to uncertainty going forward. There has been an adequate supply of US domestic beef largely because if dry conditions increasing the US cow kill, while New Zealand supplies through June were also plentiful as our bull kill was larger than expected. However, the New Zealand cattle kill the week ending July 6 dropped off significantly and once US importers realise this, we may see some upside in prices. Last week, US imported bull beef prices were firm on US$2.02/lb while 90CL cow was around US$1.90/lb.

NZ cattle kill slides

The New Zealand cattle kill fell 9% the week ending July the 6th to 48,900 head. The largest fall was recroded in the South Island, where 2,800 fewer cattle (-21%) were killed than the week prior. The North Island cattle kill was down 1,900 head or 5%.

The largest percentage fall was in the number of bulls coming to slaughter. The New Zealand bull kill was down a massive 19% or 2,200 head as it slides towards seasonal lows in late winter/spring. The New Zealand steer and heifer kill was also down 2,200 head, which represented a weekly fall of 7%.

US domestic beef in demand

After the lean fine textured beef (LFTB) saga, it was believed the demand for US imported beef would increase, but this did not eventuate. Instead, when LFTB was taken off the market, demand for US domestic beef soared seeing imported beef is not really used in retail outlets due to regulatory issues surrounding country of origin labelling (COOL). While domestic prices have risen, NZ exporters have struggled to bridge the large gap between domestic and imported beef prices while supplies have been adequate.

US to loose COOL?

On June 29, the US lost the bulk of its appeal against the World Trade Organisation (WTO) on meat labelling requirements, meaning the US will have to alter COOL. COOL is believed to have failed its legitimate objective of providing consumers with information on the origin of food. The implementation of the ruling may take over year, but once this comes through, it will likely benefit NZ beef exporters.

|

|

Market Briefs by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283. |